Equity venture capital for companies building on Bitcoin

#2 YOU CAN PRINT EUROS, BUT YOU CAN’T PRINT ENERGY

Facilitating access to cheap and abundant energy is the most fundamental objective for any government. Energy is the most important input for any advanced economy as without it, we simply don’t have an economy at all. As we watch energy prices go parabolic in Europe due to decades of centrally planned mismanagement and ideologically driven misinformation, the effect on an ordinary citizens disposable income will be crippling. Businesses and industry starved of spend and subject to extraordinary input costs will simply shut down en masse, causing defaults up the chain to their lenders. When solvency in the banking system is at risk, well, that’s when the solvency of the Sovereign is caused into question (think the Global Financial Crisis a decade ago). In the modern world, access to energy underpins every asset class.

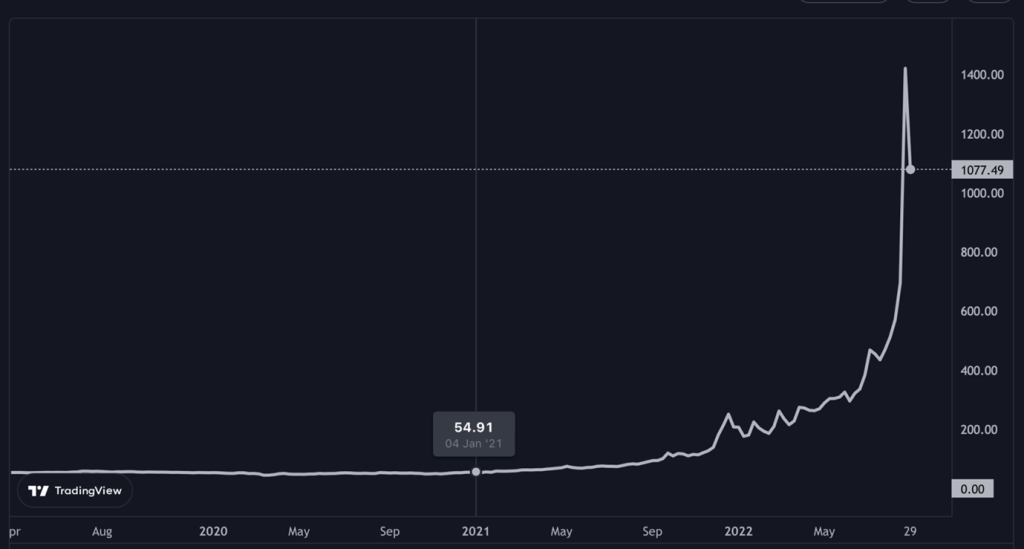

German Power Jan ’23 Futures Contracts go haywire

Sovereigns in Europe cannot allow such a scenario. And in the depths of winter the necessity of defying US sanctions to procure energy and face down domestic civil unrest will become all too clear. And how might these energy trades be settled? As Russia, why would you sell your natural resources, your real tangible assets, for paper money controlled and printed at will by a foreign power? If the seizure of treasuries by the US taught countries anything, it’s that fiat money is not neutral. Perhaps they’ll demand something else, say Rubles, or maybe they’ll look to improve their balance sheet by demanding a genuinely neutral 3rd party monetary medium, like Gold. Gold though has its flaws, not least that it cannot move at the speed of commerce in a digital world.

In the meantime, Europe is, entirely out of choice, staring down the barrel of a winter ridden with poverty and cold. An ill-thought through, unaffordable and impractical green agenda has made it so. That agenda has forced the inexplicable shut down of nuclear energy and the rapid roll out of heavily subsidised renewables that are intermittent and perversely force ever more reliance on imported (ironically from Russia) Oil & Gas. The misinformation around fracking was the nail in the coffin that once and for all removed any possibility of energy independence.

The progress of human civilisation is a story of energy and time. Energy, the master currency and time, the ultimate scarce resource. Progress is predicated on harnessing energy in increasingly productive and efficient ways in an effort to save ourselves time. When energy consumption per capita drops, living standards drop. To cross the Atlantic, we once used the power of the wind, then steam and now kerosene. Each progression is more energy consumptive but represents an increase in our quality of life.

The only question, therefore, is not how to minimise energy use but how to harness more energy in a way that is sustainable to the world around us. Bitcoin and Proof of Work provide one such solution. As I’ve written about before (here), bitcoin provides an economic incentive to build out energy infrastructure in ways where previously there were none. For example;

- Bitcoin mining improves the economics of intermittent energy sources like solar and wind by acting as instant demand for excess energy. In so doing miners act as load balancers on the grid given the bitcoin network is a 24/7 buyer of last resort for energy produced anywhere. It’s a buyer of last resort for energy because it is not profitable to mine bitcoin whilst paying retail rates. Far from being competitive to the average household for energy, it is complementary.

- Bitcoin mining allows for isolated pockets of energy to be developed into viable energy sources. The latter encourages investment into energy production as now previously unmonetisable energy sources can be monetised.

- Fossil fuels are essential components of our energy mix and fossil fuel extraction produces flared gas. This flared gas is methane, a 20x more potent greenhouse gas than carbon dioxide. With bitcoin mining the flared gas can be combusted to CO2 and the energy used to power the mining rigs. Thus, lowering the greenhouse impact of fossil fuel extraction and actually turning it into a profit centre.

So, bitcoin mining aligns our collective incentives toward prosperity and a more stable equilibrium than our existing monetary arrangement and lest we forget, this is just bitcoin mining. In future editions of this newsletter, we’ll talk about why an inflationary monetary system leads directly to resource over-consumption, why a self-custodial digital bearer asset minimises the returns to violence and why Proof of Work and its consumption of energy is the only way to guarantee property rights to every individual on the planet.

Timechain will continue to make investment into energy infrastructure a priority as we expect this to be an extraordinarily important macro theme over the coming decade.

THE TIMECHAIN UPDATE

At Timechain we are focused on backing the best teams as they build the infrastructure for billions of people around the world to onboard onto bitcoin.

Our fifth investment, not yet announced, will play on this theme heavily and complement 2 existing solutions already part of the portfolio. Galoy provides infrastructure for existing financial institutions and nation states to provide bitcoin services, whilst Fedi looks to bank the un-bankable in the global south through developing bitcoin first communities. Our unannounced fifth investment brings bitcoin to emerging markets through viral bottom-up adoption.

Whilst our bitcoin miner, Unmapped, embarks on a fresh capital raise to build a leading bitcoin miner

We believe this is a phenomenal time to build a miner as distressed energy and computing assets hit the market. The business is raising fresh capital to capitalise on several immediately available sites where the marginal cost to mine BTC is as low as $2k!

***

Our Thinking

Press

With thanks to the Timechain Calendar Team