Equity venture capital for companies building on Bitcoin

#5 The Business Model of The State

Summary

- The business model of the state is rent extraction from its citizens in exchange for goods and services

- This rent extraction comes in the form of taxes and money printing

- The cost of money printing is hidden but manifests as ‘inflation’

- This inflation causes economic instability and social decay, which pushes even democracies into a state of authoritarianism to protect the system thought to do such good for so many

- Bitcoin acts as a check on state power through separating money and state, allowing democracies to truly serve the interests of the people

***

THE STATE AND THE CITIZENRY; WHO SERVES WHOM?

Economics is like gravity in that nothing in the universe can escape it. Not even the mighty nation-state, with its all-powerful military and bureaucrats and alphabet soup of agencies, can escape the need to effectively utilise the resources at its disposal. A nation-state is simply a corporation—albeit the most extreme form of corporation imaginable due to its monopoly over violence and money. Therefore, like a corporation, the nation-state must also have a business model.

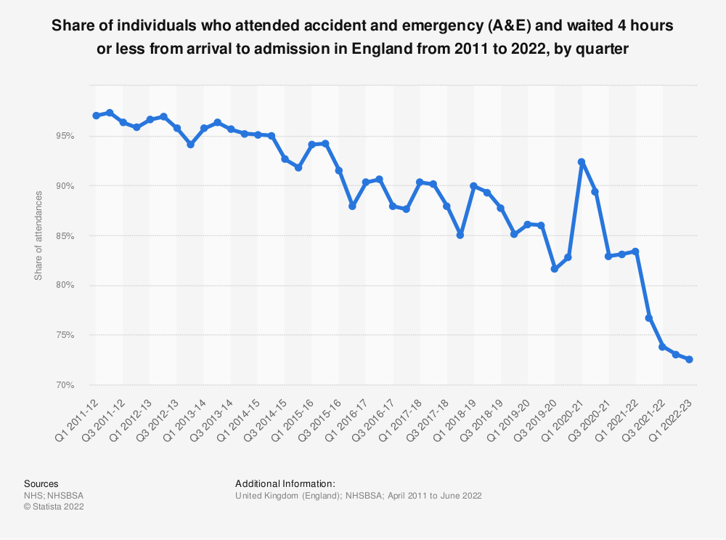

The business model of the state is rent extraction from citizens in exchange for various goods and services. In the western world, this rent extraction is conferred legitimacy through the process of democracy. Goods and services are then administered by bureaucrats in accordance with the expressed needs of the population. The problem is that these provisions are not subject to a market test. You are not the customer of the health service or the education system; the bureaucrat deciding their funding is. This absence of a true market test means a critical line of feedback between service provider and receiver is broken and is why private sector alternatives outperform state-run ones.

The paradox of government is that its departments are disincentivised to solve the problems they were originally tasked with, lest they render themselves obsolete. The welfare department perpetuates poverty; the defence department looks for offence. For example, the concern of the Department for Labour is not so much improving employment outcomes for the worst-off, but protecting the trillion-dollar budget that sustains their organisation. Would they advocate lowering or abolishing the minimum wage if it reduced the need to administer unemployment benefits? There are in fact strong arguments for such a move—consider Sweden, which does not have a minimum wage. The reality is that government departments do not shrink voluntarily; once created or expanded, they are driven to justify their continued existence.

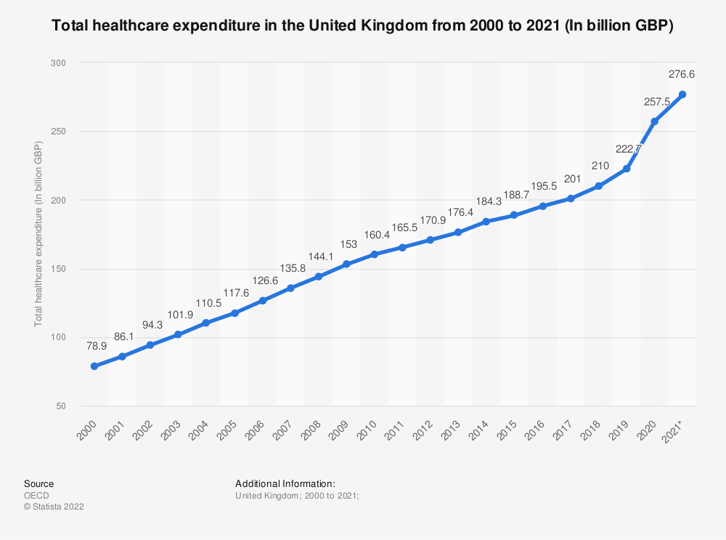

“If all you have is a hammer, everything is a nail.” It is natural to attempt to fix the problems you see with the tools at your disposal, even if those tools aren’t fit for purpose. Lawmakers will only ever pass more laws, that is their function. Yet this means the state continues to grow and the regulatory regime becomes more labyrinthine. In an era of record state spending, the problems toward which that spending is channelled are only getting worse. What exactly has any of the prior spend achieved, beyond swelling the state apparatus? Considering past performance, it’s more than reasonable to ask whether more spending will make any difference at all.

The government is not an effective allocator of capital, yet it seeks to control an ever-increasing share of its deployment across the West. It does so by extracting what it can and creating the rest, consequences be damned.

***

Part II

In Part 2, we explain why money printing leads to social and economic decline and how Bitcoin, as an unmanipulable monetary platform provides a stable bedrock for civilisation to build from!

THE CONSEQUENCES OF MONEY PRINTING FOR LEVIATHAN

The profligate and leviathan state supports itself through two forms of rent: taxes and money printing. The ability of the state to unilaterally print money it also enforces the usage of is not a new phenomenon. The abuse of such power has contributed to the downfall of mighty empires from Rome to the Mongols. What formerly may have been known as ‘coin clipping’ is simply now referred to as quantitative easing or a stimulus package and handily justified by Keynesian academics or proponents of nonsense like MMT. The digital nature of fiat has made this easier than ever. When money is just numbers on a screen with a marginal production cost of 0, infinite money-creation is a temptation impossible to refuse for a central authority desperate to spend.

Even today, even in the West with our free, fair elections and institutional checks and balances, this monopoly on money by the state poses a significant problem. Democracies combined with manipulable monetary systems are an unstable equilibrium. If we care about maintaining democracy, we ought to care about corruption in the monetary system.

To see the corrupting influence of the money printer clearly, think of how politicians seek to win elections by promising largesse to the electorate in an ever-intensifying cycle. As taxes alone cannot fund these extravagant commitments, money printing is required to do the rest. This monetary debasement is an extremely useful tool for politicians as the true costs of their election promises are covertly externalised on the productive elements of society—those generating the wealth to support the value of the currency in the first place.

Money should reduce future uncertainty. Once you earn economic energy through expending labour and time, it should be yours to deploy when you need it most. One’s savings ought to offer the psychological comfort of not diminishing over time, but with monetary debasement inherent to the fiat system, your economic energy is bled out. And so, we are forced to speculate with it, to ‘invest’, to achieve returns that allow us to keep pace with its inevitable debasement. You must earn your money twice. Hence the excessive financialization of our economic system—think of subprime mortgages, the push to fractionalise real estate, retail access to options investing with 100x leverage, sports betting, hedge funds that specialise in nice assets like wine and the over-prevalence of money managers. We search for ever more exotic and risky financial instruments in the perennial hunt for yield, all to beat the anticipated rate of debasement. Though monetary debasement is not the same as inflation as viewed through a metric like CPI, the former does lead to the latter. And aside from the excessive financialisation of our economy, inflation has other disastrous consequences.

First among these is that it leads to social decay as written about previously in this newsletter. When inflation is high, the middle-class struggle to make ends meet and become the working poor. My favourite example of the insidious impact of inflation is that of the winemaker who sells a bottle of wine for $10. If his input costs rise by 5%, he has three options. He can raise prices to offset the cost, he can water down the wine (trading off on quality or quantity—see “shrinkflation”), or he can accept the hit to his bottom line. These are all bad options. The inflation built into the system leaves economically productive actors with few alternatives.

The result is a decaying of the fabric of society often manifested in strikes, boycotts, or protests (a familiar story right now to those in the UK). To appease the disenfranchised, governments that strenuously deny their money printing caused inflation in the first place (Inflation is not linked to stimulus – Janet Yellen) will print yet more money! Systemic issues, bank system collapses, ‘one-off’ disasters like Covid, or even bouts of inflation itself are papered over by throwing money at the problem. This introduces more instability into the system as the root cause is never addressed, which is why each new stimulus package is an order of magnitude bigger than the previous.

To anyone but a Marxist, the absurdity of 12 elders in a room setting the price of money every 6 weeks should be clear, but its pernicious consequences are less so. It is the manipulation of interest rates that facilitates monetary creation (inflation) or destruction (deflation). By not allowing the price of money to achieve a natural market clearing rate, sustainable economic development cannot occur. Who is to say if a business is a healthy business if propped up by capital that is artificially cheap? And what about the businesses for whom that first business is a critical element of their supply chain? And why should the retirement age for your loved ones be so critically dependant on the political (or not) objectives of the US Federal Reserve? Especially if you live in say, Thailand or the Congo.

Such a corrupted monetary system almost inevitably leads to a slide towards authoritarianism, even in democracies. Governments perceive no choice but to clamp down on freedoms to combat the social decay brought about by debasement. After all, the current system provides such mighty wonders as ‘universal healthcare’, ‘free’ education,’ and law and order. This does not mean politicians are bad people; they will simply do what they think necessary to protect the system from collapse, not understanding that an altogether alternative system is required. Covid is an instructive example. Fearing the threat to the fabric of the nation itself, the system removed immediately and without hesitation freedoms millions had fought and died for over thousands of years. This was no trivial matter; citizens were refused access to their own country, curtailed from leaving and denied freedom of movement within the country itself!

Modern technology amplifies these risks by enabling the state to corral its population more effectively than ever before. Financial censorship has always been a favoured tool of repression, and with the inevitable introduction of CBDCs (Central Bank Digital Currencies) it will become much easier indeed. Fiat currency is already digital and as such the only purpose of a CBDC is to increase surveillance and control of the population. The programmatic nature of CBDCs mean they will inevitably be combined with ‘social credit’ scores, CCP style, to encourage behaviours approved by the political regime of the day. Think of the restrictions placed on the individual through issuing food stamps rather than cash; now imagine those principles applied to all the money you earn. It’s reasonable to imagine a future government instituting a per capita carbon quota and looking to manage individual spend to ensure such a quota is not exceeded. Or perhaps your attendance of certain protests or expression of certain opinions on social media will forfeit your right to spend money entirely, indeed this has already happened in Canada. When money is limited in how, where, and on what it can be spent, it ceases to be money and is more akin to a coupon.

Democracy has been observed on the retreat all around the world. Many would-be causes have been proposed, from social media polarisation, climate change, and natural resource shortages to the rise of populists and strongmen. But what if they are all just symptoms of a deeper malaise? What if the root cause of the decay in freedoms is our corrupted monetary arrangement? Civilisation is built on top of a ledger. The ledger records our individual preferences as expressed through how we communicate what we value to one another. That ledger used to be gold, now it is fiat. Root access to the fiat ledger is managed by the nation state and the nation state corrupts it at will. The consequence is an increasingly unstable social order even in democracies, in turn leading to a more authoritarian state out of necessity for maintaining control.

DOES BITCOIN FIX THIS?

‘The computer can be used as a tool to liberate and protect people, rather than to control them’.

Hal Finney, 1992

The question of our time, as the imperious Dergigi has put it, is ‘who should be allowed to issue and control the money?’

The status quo fiat system says it should be the government, the central planners running our treasuries, and the bankers to whom credit creation is so natural. As we’ve discussed, the consequences are a frayed social order and a stunted economic one.

But bitcoin offers an alternative. It says nobody should be able to print money, corrupt it, or benefit from proximity to the money printer. It says money should only be obtained in return for valuable goods and services provided in a free market. That extends to the government too.

Bitcoin is 12 words in your head, literally. The knowledge of these 12 words is enough to store and manipulate your bitcoin as you see fit. Further, it is impossible for anyone else to gain knowledge of those 12 words. The government or any third party cannot take your bitcoin from you unless you are coerced through the threat of violence OR you willingly provide bitcoin to them. They cannot tax it, they do not know how much you have and they cannot print it. They must mine it by expending energy in the real world via proof of work (non-0 marginal cost of production) or they must provide valuable goods and services to obtain it. In this way, governments transition to being service providers competing to provide value for money, rather than overlords extracting economic energy at will. Bitcoin forces the state to provide value commensurate with the value they extract, as economic energy cannot be siphoned away in secret.

‘People need a monetary asset that cannot be debased running on a network that cannot be censored governed by a protocol that cannot be corrupted. Only bitcoin meets these requirements.’

Michael Saylor

Our Thinking

Press

With thanks to the Timechain Calendar Team